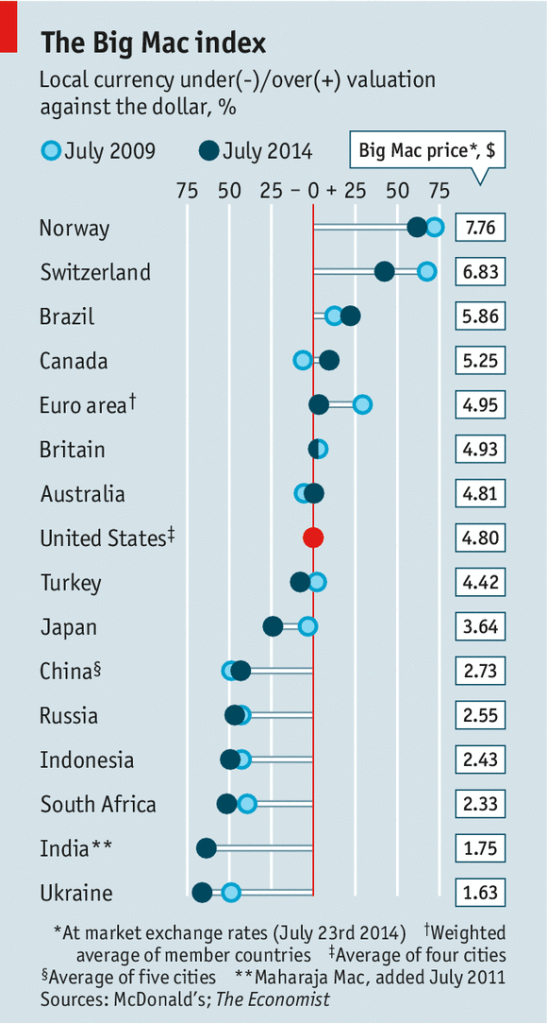

We call the implied exchange rate the purchasing power parity (PPP) because this rate would have equalized the price of the big mac in both countries.īut the actual exchange rate was only 6.51 kroner per dollar. In other words, the implied exchange rate should be (40 kroner/$3.57 = ) 11.2 kroner per dollar.

If $3.57 could buy 40 kroner in the foreign exchange market, the big mac in Norway would have cost the American buyer the same in both countries.

The big mac sold for 40 kroner in Norway and $3.57 in the US in 2009. The big mac index provides an interesting perspective into the determination of foreign exchange rates.

0 kommentar(er)

0 kommentar(er)